Introduction

The European stock market plays a critical role in the global economy, serving as a barometer for economic health across the region. Whether you’re an investor, analyst, or casual observer, understanding the market’s daily performance is vital for making informed decisions. Today, the focus is on the latest developments in European markets, where every fluctuation can signal broader economic trends.

At FintechZoom, we provide live updates to ensure you’re always informed about the latest movements in the European stock market. From index performances to company highlights, our platform equips you with the insights you need to navigate this ever-changing landscape.

What Drives the European Markets?

European markets are influenced by various factors that shape their daily performance and long-term trends. Understanding these drivers can provide critical insights into the region’s financial health.

- Economic Policies: Decisions by the European Central Bank (ECB), such as interest rate changes or quantitative easing programs, directly impact the European stock market. For instance, lower interest rates often boost investor confidence, leading to market rallies.

- Geopolitical Events: Brexit, energy crises, or trade negotiations heavily influence European market trends. Political stability within the European Union also plays a major role in investor sentiment.

- Global Market Trends: The performance of U.S. and Asian markets often correlates with European indices. A strong rally in the U.S. market, for instance, might spark optimism across Europe, impacting indices like the FTSE 100, DAX, and CAC 40.

- Corporate Earnings and Sector Trends: Quarterly earnings reports from top companies, particularly in industries like finance, technology, and energy, set the tone for the European financial markets. Positive earnings results often drive sector-wide momentum.

By staying updated on these factors through platforms like FintechZoom, you can gain a deeper understanding of what moves the European stock market and make better investment decisions

European Stock Market Overview (Today)

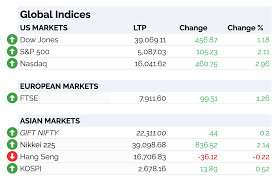

As of today, the European stock market is witnessing dynamic activity across its major indices. Key benchmarks, such as the FTSE 100, DAX, and CAC 40, are showing mixed results as investors react to recent economic data and global trends.

Major Indices Performance

- FTSE 100 (UK): The index has seen steady growth today, driven by gains in the energy and banking sectors. However, uncertainty around inflation data continues to cap further upward momentum.

- DAX (Germany): Germany’s leading index has experienced slight dips, primarily due to weaker-than-expected corporate earnings from its industrial giants.

- CAC 40 (France): French markets are showing resilience, with tech stocks leading the rally after a positive quarterly report from a major European software firm.

Gainers and Losers

- Top Gainers: Companies in the renewable energy and pharmaceutical sectors have shown strong growth today.

- Top Losers: Automotive and luxury goods stocks have faced pressure due to concerns about rising production costs and slowing consumer demand.

Sector Highlights

- Energy: Rising oil prices have boosted stocks in this sector.

- Technology: A wave of optimism around AI advancements has spurred interest in European tech firms.

- Finance: Banks are performing well amid expectations of stable interest rate policies from the European Central Bank.

For detailed and live updates on the performance of these indices, turn to FintechZoom, where we provide real-time insights into the ever-evolving European financial markets.

Breaking Down Market Movements

Today’s movements in the European stock market reflect a mix of global and regional influences, underscoring the interconnected nature of financial markets. Let’s dive into the key drivers shaping the markets today.

Major Economic News

- Inflation Data: Recent inflation reports across the Eurozone have played a significant role in today’s market movements. Countries like Germany and France reported inflation figures that exceeded expectations, putting pressure on the European Central Bank (ECB) to reconsider its monetary policy stance.

- Interest Rate Speculations: Markets are reacting to hints from the ECB about potential adjustments to interest rates. A dovish stance has helped support sectors like real estate and utilities.

Global Influences

- U.S. Market Trends: A strong performance in U.S. markets last night, driven by robust tech earnings, has positively impacted European tech stocks today.

- China’s Economic Data: Weak export data from China has slightly dampened sentiment in sectors dependent on global trade, such as automotive and luxury goods.

Market Sentiment

The overall sentiment today is cautious yet optimistic, with traders closely monitoring any updates from the ECB and geopolitical developments. Bullish trends are evident in growth-oriented sectors like technology and clean energy, while defensive sectors remain stable amid broader uncertainties.

Staying informed on these movements is essential for understanding the trends shaping the European markets today. Platforms like FintechZoom provide real-time analysis, ensuring that you never miss crucial updates on market activity.

Key Companies and Stocks to Watch

In today’s European stock market updates, several key companies are making waves with their performance. Whether they are major players in their industries or emerging growth stories, these stocks are attracting the attention of investors across the globe.

1. Volkswagen Group (Germany)

Volkswagen continues to be a standout in the European financial markets today, with its stock climbing after the announcement of stronger-than-expected quarterly earnings. The company’s push into electric vehicles (EV) and innovations in sustainable technology are positioning it well in the global automotive sector.

2. LVMH (France)

The luxury goods giant LVMH is showing solid performance, driven by strong demand in the Asia-Pacific region. As one of the leading stocks on the CAC 40, LVMH’s resilience amid global economic uncertainty makes it a stock to watch closely.

3. Unilever (UK)

Unilever’s stock is on the rise today, reflecting its robust earnings in the consumer goods sector. The company’s focus on sustainable products has helped it maintain steady growth, making it an attractive pick for long-term investors in the European markets.

4. HSBC Holdings (UK)

As one of Europe’s largest banks, HSBC remains a key player in the European stock market. Its stock performance today is tied to optimism around stable interest rates and its expanding presence in Asia.

5. SAP (Germany)

SAP, the enterprise software leader, is performing well as the demand for cloud-based solutions continues to rise. With European tech stocks gaining traction, SAP is one to keep an eye on for both growth and value investors.

6. Royal Dutch Shell (Netherlands/UK)

The oil giant Shell continues to benefit from rising energy prices. Its stock is a top performer today, reflecting the ongoing global energy demand.

Tracking the performance of these key companies is crucial to understanding broader market trends. For those seeking real-time insights into the European financial markets, FintechZoom offers up-to-the-minute data on stock movements, earnings reports, and more.

European Indices Performance

The performance of European indices provides a clear snapshot of the region’s economic health. Today, the movement of these indices highlights investor sentiment, economic news, and sector performance. Here’s a closer look at the major indices driving the European stock market today.

1. FTSE 100 (UK)

The FTSE 100 has seen moderate gains, primarily driven by growth in the energy and banking sectors. Despite concerns about inflation in the UK, the index is benefiting from the strength of large multinational companies. Stocks in energy, like Royal Dutch Shell, are seeing strong upward movement due to rising oil prices, while financial stocks are buoyed by the stable interest rate outlook from the Bank of England.

2. DAX (Germany)

Germany’s DAX index has experienced slight downward pressure today, influenced by mixed earnings reports from major corporations and ongoing global economic uncertainties. However, the index remains resilient due to the strong performance of industrial stocks. Volkswagen, in particular, is driving a segment of the index higher, thanks to its growth in electric vehicle production.

3. CAC 40 (France)

The CAC 40 is showing positive momentum, with a strong performance in the technology and luxury sectors. The luxury goods market, led by LVMH, continues to thrive despite global challenges, offering a boost to the index. The market’s overall optimism reflects strong corporate earnings and growing consumer confidence in France.

4. IBEX 35 (Spain)

Spain’s IBEX 35 has been slightly more volatile today, with mixed results across sectors. Despite strong performances from some of its top companies, the index faces headwinds due to global trade concerns, particularly as markets digest weaker-than-expected data from China.

5. Other Regional Indices

- OMX Stockholm 30: The Swedish index has shown moderate growth today, led by strong performances from tech companies.

- AEX (Netherlands): The Dutch index is flat, with energy and financial sectors providing some balance to losses in the consumer goods sector.

Overall, the performance of these indices today provides a mixed but largely stable outlook for the European markets. Understanding how these movements reflect broader economic trends is essential for investors.

For real-time updates on these indices and more, FintechZoom offers detailed analysis and live market tracking, helping you stay ahead in the fast-paced world of European financial markets.

Forex and Commodities Updates

In addition to stock market trends, forex, and commodity markets play a critical role in shaping the overall performance of the European markets today. Movements in currency pairs and commodity prices often correlate with broader economic developments and investor sentiment. Let’s explore how these markets are performing today.

Forex Market Updates

The forex market is showing notable activity today, with several currency pairs reflecting shifting investor expectations and global economic indicators.

- EUR/USD: The Euro has strengthened slightly against the U.S. Dollar, benefiting from positive economic data from the Eurozone, particularly in manufacturing and services sectors. This has led to a rise in the value of the Euro, providing some relief to European exporters.

- GBP/EUR: The British Pound remains under pressure as investors digest concerns over inflation and trade negotiations. The GBP/EUR pair has seen volatility, especially after recent UK inflation reports and political developments.

- USD/JPY: The U.S. Dollar has strengthened against the Japanese Yen today, reflecting expectations of higher U.S. interest rates and positive sentiment in global equity markets.

Commodities Updates

Commodities, particularly oil and gold, have shown significant movement today, with supply-demand dynamics and geopolitical factors at play.

- Oil: Crude oil prices are rising, reflecting tightening global supplies and ongoing demand from key markets. This upward movement has been supportive for energy stocks across Europe, including Shell and other oil majors.

- Gold: Gold prices have remained relatively stable, though there is cautious optimism as investors seek safe-haven assets amid global uncertainties. As inflation concerns rise in Europe, gold often becomes a preferred asset for hedging against inflationary pressures.

- Natural Gas: Natural gas prices are experiencing volatility due to fluctuating weather patterns and energy demand in Europe. The continued recovery in demand post-pandemic is helping to keep prices elevated, benefiting companies in the energy sector.

Both the forex and commodity markets are crucial in understanding the broader movements in the European financial markets today. Their impact on investor sentiment and trade decisions cannot be overlooked. For real-time updates and deeper analysis of forex and commodity trends, FintechZoom offers valuable resources and live data feeds.

Expert Insights and Predictions

As European markets continue to fluctuate today, expert opinions and market predictions offer valuable guidance for investors and traders looking to navigate this dynamic environment. Let’s explore the key insights and projections from financial experts on what to expect shortly for the European stock market.

1. Short-Term Outlook: Cautious Optimism

Experts are generally maintaining a cautious optimism for European markets in the short term. While concerns about inflation and global trade uncertainties persist, there is a strong belief that the markets are poised for moderate growth.

- Economic recovery in key sectors like technology and energy, along with solid earnings reports, are expected to keep driving performance in these sectors.

- However, rising interest rates and inflationary pressures in Europe could cap gains in more volatile sectors like consumer goods and retail.

2. Long-Term Growth Potential

Looking further ahead, many analysts remain optimistic about the long-term growth prospects for European markets.

- Green energy and technology stocks are likely to be key drivers of growth in the next few years, with companies in renewable energy and digital transformation leading the charge.

- ESG (Environmental, Social, Governance) investments are expected to continue gaining popularity, as European investors place increasing emphasis on sustainability and ethical investing.

- Geopolitical risks, such as political instability and supply chain disruptions, remain significant threats to market stability, but experts believe that the European financial markets are resilient enough to weather these challenges.

3. Expert Recommendations for Investors

- Stay Diversified: Many experts advise maintaining a diversified portfolio to mitigate risks, especially with the ongoing volatility in the markets. A mix of stocks, bonds, and alternative assets can provide stability.

- Focus on High-Growth Sectors: Investors are encouraged to focus on high-growth sectors, particularly technology, green energy, and biotech, which are expected to perform well as part of Europe’s economic recovery.

- Monitor Inflation Trends: Close attention should be paid to inflationary data and ECB policy decisions. Rising inflation could lead to tighter monetary policies, which might impact riskier assets.

These insights help investors better understand the current landscape and what strategies they can adopt to navigate the European stock market moving forward. With real-time updates and expert commentary, FintechZoom keeps you informed about the latest trends, helping you make smarter investment choices in a volatile market.

How FintechZoom Adds Value to Your Market Research

In an environment where European markets can shift rapidly, staying informed and making timely decisions is crucial. This is where FintechZoom plays a vital role in helping investors, analysts, and financial professionals stay ahead of market trends.

Real-Time Market Updates

FintechZoom provides live updates on stock market movements, including major European indices like the FTSE 100, DAX, and CAC 40. Whether you’re tracking a particular sector or specific stocks, FintechZoom offers up-to-the-minute data that allows you to stay ahead of the curve. This level of real-time information is invaluable for making informed decisions quickly and efficiently.

Comprehensive Coverage of Global and European Markets

While FintechZoom excels in European stock market updates, it also provides comprehensive coverage of global financial markets. You can track how U.S. and Asian markets are influencing European trends, helping you understand the bigger picture. Whether you’re following the latest forex movements or commodity prices, FintechZoom ensures you have access to all the key market insights needed for strategic decision-making.

Expert Analysis and Predictions

With expert insights from leading financial analysts, FintechZoom offers a detailed market analysis that goes beyond the surface-level updates. By understanding the factors behind market movements—such as economic reports, geopolitical events, and sector trends—you can make more informed investment choices. FintechZoom’s expert forecasts help you anticipate shifts in European markets, giving you a competitive edge in the financial landscape.

Customizable Alerts and Notifications

To ensure you never miss a key market move, FintechZoom allows you to set customizable alerts. Whether it’s a significant shift in forex markets or breaking news on European stocks, you can receive notifications based on your specific interests and investment strategies. This feature is designed to help you respond promptly to market opportunities or risks.

By integrating FintechZoom into your research process, you gain access to a wealth of data, insights, and tools that make staying on top of European financial markets easier and more effective. Whether you’re a seasoned investor or a market newcomer, FintechZoom provides the resources you need to make confident, well-informed decisions.

Conclusion

As we’ve explored today, European markets are continuously evolving, influenced by a range of economic, geopolitical, and corporate factors. From the performance of major indices like the FTSE 100, DAX, and CAC 40, to the impact of global events on sectors such as energy, technology, and finance, staying informed is key to navigating these changes effectively.

The importance of monitoring real-time market updates cannot be overstated, and platforms like FintechZoom play a crucial role in providing live, accurate data, expert insights, and in-depth analysis. Whether you’re tracking the latest trends in forex, commodities, or individual stocks, having access to reliable, up-to-the-minute information helps investors make smarter decisions.

The European stock market today offers opportunities as well as challenges, but with the right tools and insights, you can stay ahead of the curve. By leveraging the resources offered by FintechZoom, you can make more informed investment choices, capitalize on emerging trends, and navigate the complexities of the financial markets with confidence.

тор blacksprut – блэкспрут сайт, настоящий сайт blacksprut

блэкспрут площадка – блэкспрут тор, ссылка на blacksprut

актуальная ссылка на omg – официальное ссылка омг омг, omg ссылка тор

“You get some of me but not tomorrow as they want me in as soon as I can make it happen. This is the one time when they say jump and I ask how high due the financial gains the company could benefit from and it being important enough for the client to appear in person.”

“Well I get an extra night of you at least! I wonder what we could do with that? Meantime, what about food? I am starving and delicious as it was a second breakfast is not quite enough to replenish me!”

“Well get something on and we’ll sort that out first.”

We drove into town and decided that a daytime visit to Charlie’s was going to be the answer. I parked in the bar lot and Elise dashed in to change into something more appropriate, jeans and a t-shirt along with her biker jacket but keeping her Converses on.

Walking down to the restaurant was different from the middle of the night visits as the streets were bustling and all of the shops and outlets were open.

Reaching Charlie’s we entered the front door and sat in a booth near the window. A beautiful young American Chinese girl came,smiled and said hello to Elise and gave us menus and asked if we wanted drinks in the meantime.

“No thanks Lin just a pot of Jasmine tea for us please.” Lin went back to the kitchen area. “No booze for me today as I will have to work in the bar so it is just tea for me.”

Not in a drinking mood either, I agreed with her.”

https://www.hentai-foundry.com/user/taiga1987/profile

https://www.hentai-foundry.com/user/anzhelee1997/profile

https://rentry.org/wzbc9dnp

https://www.obesityhelp.com/members/najlbl41980/about_me/

https://permacultureglobal.org/users/63340-craig-johnson

Омг омг оригинальная ссылка – омг сайт, омг омг ссылка на сайт

omg рабочая ссылка – omg omg tor ссылка, omg omg официальная ссылка на тор браузер

blacksprut зеркала онион – блек спрут ссылка, блэк спрут ссылка

блэкспрут – блек спрут оригинальная ссылка, блэкспрут сайт

blacksprut официальный сайт – блэкспрут официальный сайт, блекспрут

не работает сайт blacksprut – blacksprut вход, блэкспрут тор

блэкспрут – блэк спрут зеркала, black sprut

omg omg ссылка тор – омг омг онион, омг омг ссылка на сайт

“You get some of me but not tomorrow as they want me in as soon as I can make it happen. This is the one time when they say jump and I ask how high due the financial gains the company could benefit from and it being important enough for the client to appear in person.”

“Well I get an extra night of you at least! I wonder what we could do with that? Meantime, what about food? I am starving and delicious as it was a second breakfast is not quite enough to replenish me!”

“Well get something on and we’ll sort that out first.”

We drove into town and decided that a daytime visit to Charlie’s was going to be the answer. I parked in the bar lot and Elise dashed in to change into something more appropriate, jeans and a t-shirt along with her biker jacket but keeping her Converses on.

Walking down to the restaurant was different from the middle of the night visits as the streets were bustling and all of the shops and outlets were open.

Reaching Charlie’s we entered the front door and sat in a booth near the window. A beautiful young American Chinese girl came,smiled and said hello to Elise and gave us menus and asked if we wanted drinks in the meantime.

“No thanks Lin just a pot of Jasmine tea for us please.” Lin went back to the kitchen area. “No booze for me today as I will have to work in the bar so it is just tea for me.”

Not in a drinking mood either, I agreed with her.”

https://www.obesityhelp.com/members/nagisp19861962/about_me/

https://rentry.org/aopvqdeh

https://www.obesityhelp.com/members/elitwoman1993/about_me/

http://www.babelcube.com/user/david-palma

https://anotepad.com/notes/g8jncpwg

Learn More Here https://web-sollet.com/

try this site https://trusteewallet.org/

Trust willowsunion.COM for secure transactions and efficient crypto exchange backed by robust security measures.

The service at Willowsunion.com is incredibly reliable. Fast and efficient!

I recently started using WillowsUnion.com and I’m blown away by how efficient it is. The exchange rates are unbeatable!

The support team at Willowsunion.com is fantastic! Always there to help.

get redirected here https://jaxx-liberty.com/